27+ Average mortgage calculator

Factors in Your Texas Mortgage Payment. Applying current mortgage loan rates you can estimate the following average monthly mortgage payments.

Bond Equivalent Yield Formula Calculator Excel Template

A size standard which is usually stated in number of employees or average annual receipts represents the largest size that a business including its subsidiaries and affiliates may be to remain classified as a small business for SBA and federal contracting programs.

. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. The houses that do go on the market are only there for an average of 27 days before offers are made. If the cost of housing relative to the average income in a city is high it will be seen as a less.

Rates are influenced by the economy your credit score and loan type. With this format the first number tells you how long rates are fixed for the second number tells you how many years the loan will adjust for. Compare and see which option is better for you after interest fees and rates.

For instance in February 2010 the national average mortgage rate for a 30 year fixed rate loan was at 4750 percent 5016 APR. Home buyers in the US move on average of once every 5 to 7 years. Luckily Floridians dont have it bad with tax rates near or below the national average.

In the third quarter of 2020 912 of all mortgages used fixed-rate loans. On Thursday September 15 2022 according to Bankrates latest survey of the nations largest mortgage lenders the average 30-year fixed mortgage refinance rate is 6190 with an APR of 6210. One benefit of buying a property in California is its buyers protections.

Property taxes in Texas are known for being quite high compared to the rest of the country. 127 South Dakota. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

If youre moving from Portland Oregon to sunnier San Diego youll see a 9 increase in your cost of living on average. 300 25 years in 76296. See the monthly cost on a 250000 mortgage over 15- or 30-years.

Average interest rate predictions put 30-year fixed rates at 388 and 15-year fixed rates at 327 in 2022. Youll pay 27 more on average to live in the Bay Area due to much higher food housing and tax costs. With the tax deduction the effective mortgage rate is 511 percent.

127 of total loans. The average fixed-rate mortgage was priced at 191. Mortgage Legal Issues in California.

Its one of the first things to add to your housing budget if youre planning on buying a home in the state. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually. National Average Contract Mortgage Rate Bill Swap Rate BBSW Some lenders may choose to use a.

Thats about two-thirds of what you borrowed in interestIf you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage. The average mortgage interest rate is around 55 for a 30-year fixed mortgage. In regards to the calculator the average return for the first calculation is the rate at which the beginning balance concludes as the ending balance based on deposits and withdrawals that are made in.

For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1796 monthly payment. If you fall behind on payments the lender may seize your home. The loan is secured on the borrowers property through a process.

When it comes to 15-year mortgage rates they predict an average between 30 and 35. The average effective property tax rate is 169 which is good for seventh-highest in the US. Use SmartAssets free mortgage calculator to estimate your monthly mortgage payments including PMI homeowners insurance taxes interest and more.

The national averages include all homeowners including those who have built up equity worked their way up the pay scale and established high credit scores. You can input your zip code or town name using our property tax calculator to see the average. The definition of small varies by industry.

Loan amount. The average property price will run you around 473910. ClosingCorp Reports Average Mortgage Closing Cost Data for 2019.

Your total interest on a 500000 mortgage. Or one could have a 228 or 327 ARM. When youre calculating the costs of buying a home youll need to think about property taxes in addition to your monthly mortgage payments.

This equates to 27 percent of the 7 percent rate on the loan. Use Ratehubcas Mortgage Affordability Calculator to help figure out the maximum purchase price that you can qualify for. Monthly mortgage payment calculator See how much youll pay for your home.

Mortgage rates vary depending upon the down payment of the consumer their credit score and the type of loan that will be acquired by the consumer. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1257 monthly payment. Sutton is the second quickest moving market with homes being on the market for an average of 28 days before an offer is made.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Todays national mortgage rate trends. A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages.

Calculator Rates 5YR Adjustable Rate Mortgage Calculator. Additional Mortgage Payment Calculator. 240 20 years in 63428.

Those under age 57 in 2021Generation X millennials and Generation Zonly represented 27 of the perfect 850 class. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Related Investment Calculator Interest Calculator.

The effective property tax rate in Florida. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. National Average Mortgage Rates.

Assuming you have a 20 down payment 70000 your total mortgage on a 350000 home would be 280000. The government pitches in 189 percent of the cost of interest through the tax deduction. These three areas are also.

Perfect 850 FICO Scores by Generation Length of credit history is a factor in determining your credit score and although there may be a few exceptions theres not much consumers can do to extend their credit history. 1700 per month on a 30-year fixed-rate loan at 329 First-time homebuyers. Year Beginning balance Monthly payment.

For today Friday September 16 2022 the current average rate for the benchmark 30-year fixed mortgage is 628 up 17 basis points over the last seven. Factors in Your Florida Mortgage Payment. Assuming you have a 20 down payment 100000 your total mortgage on a 500000 home would be 400000.

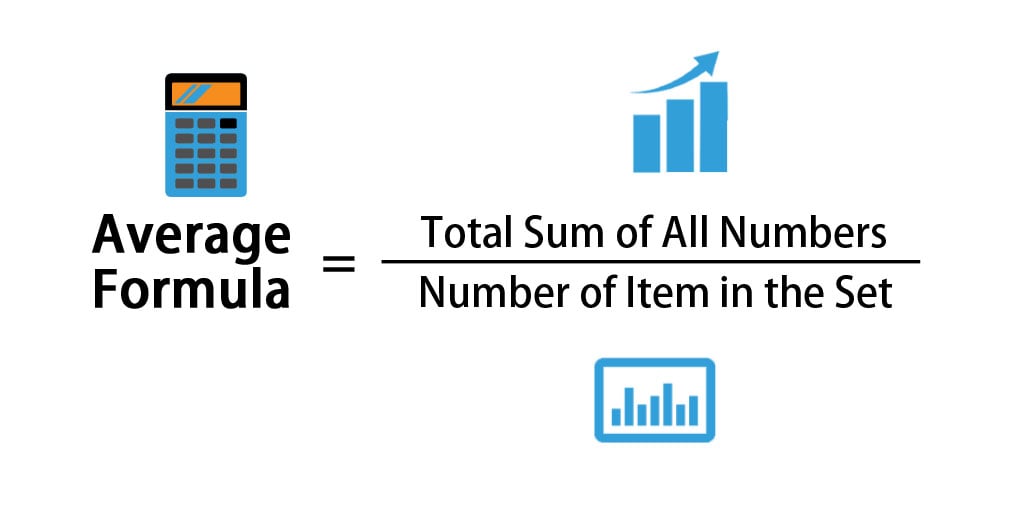

The average return is defined as the mathematical average of a series of returns generated over a period of time.

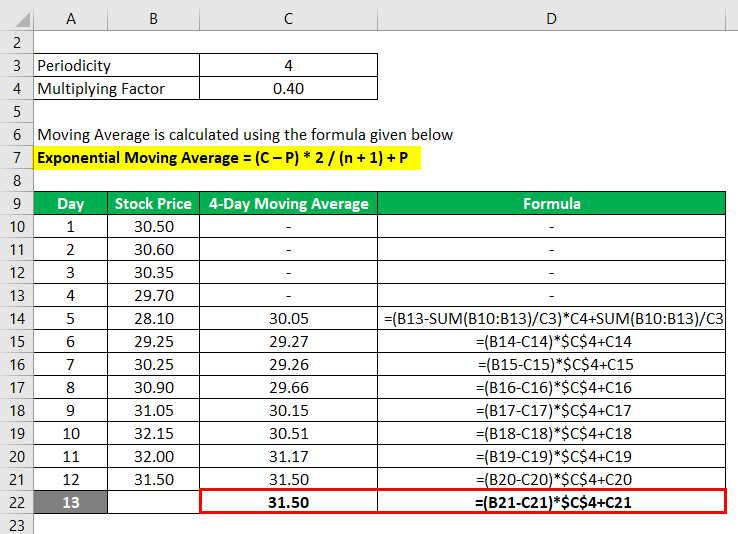

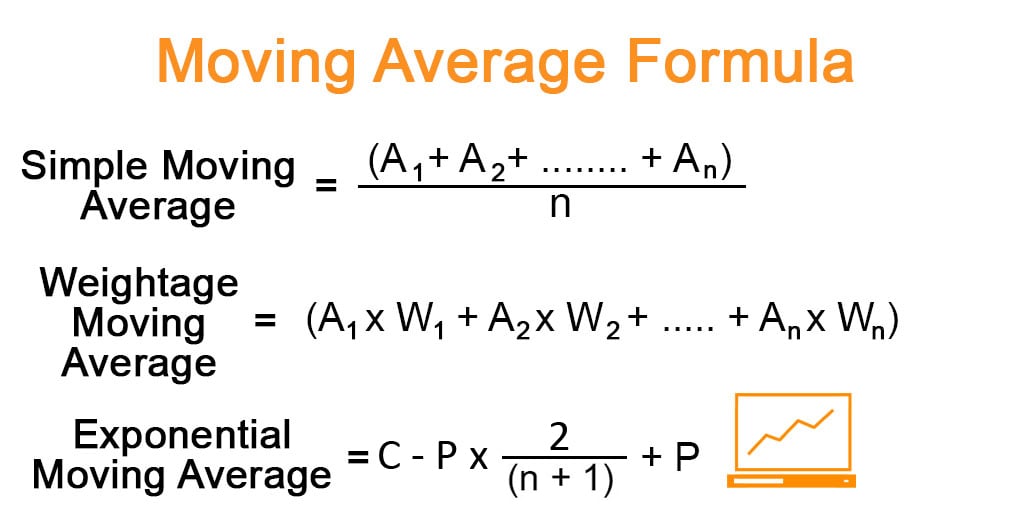

Moving Average Formula Calculator Examples With Excel Template

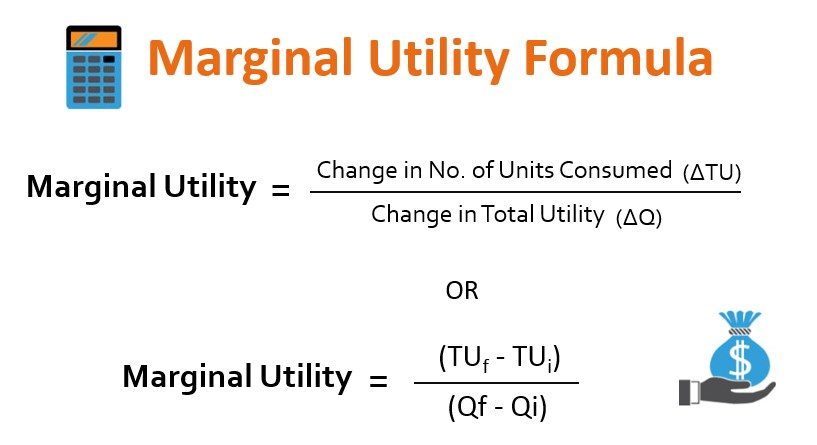

Marginal Utility Formula Calculator Example With Excel Template

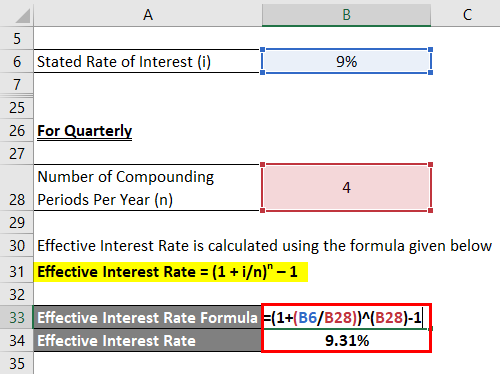

Effective Interest Rate Formula Calculator With Excel Template

Mortgage Calculator Monthly Payments Screen Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Amortization Calculator

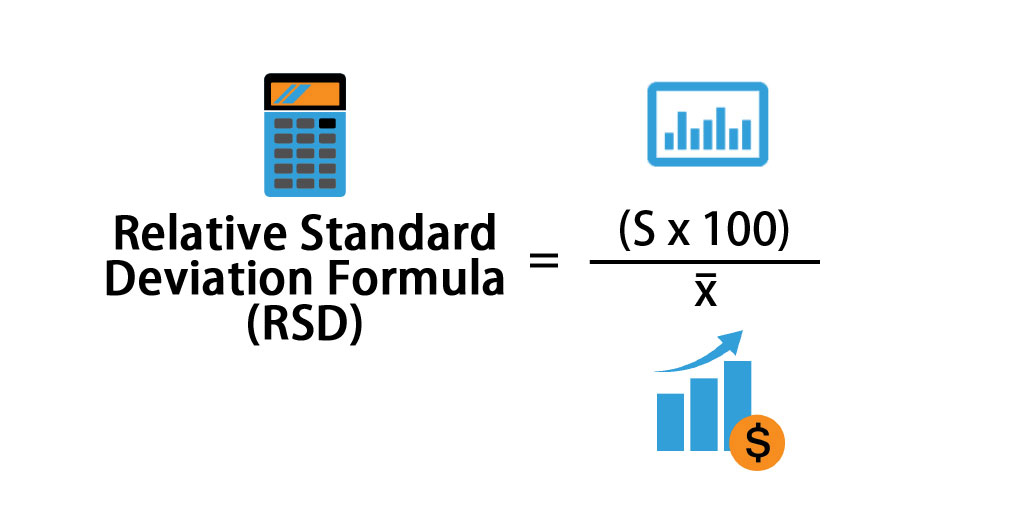

Relative Standard Deviation Formula Rsd Calculator Excel Template

Effective Interest Rate Formula Calculator With Excel Template

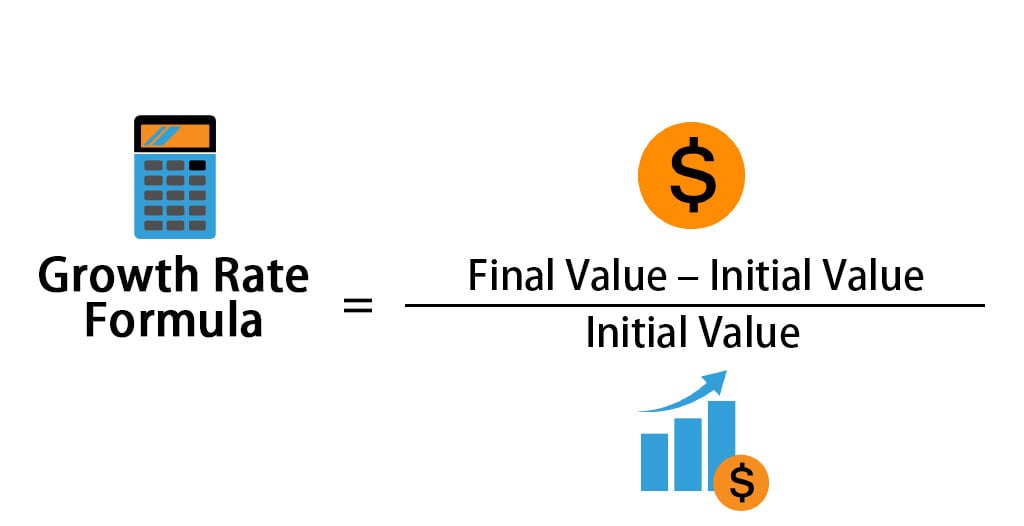

Growth Rate Formula Calculator Examples With Excel Template

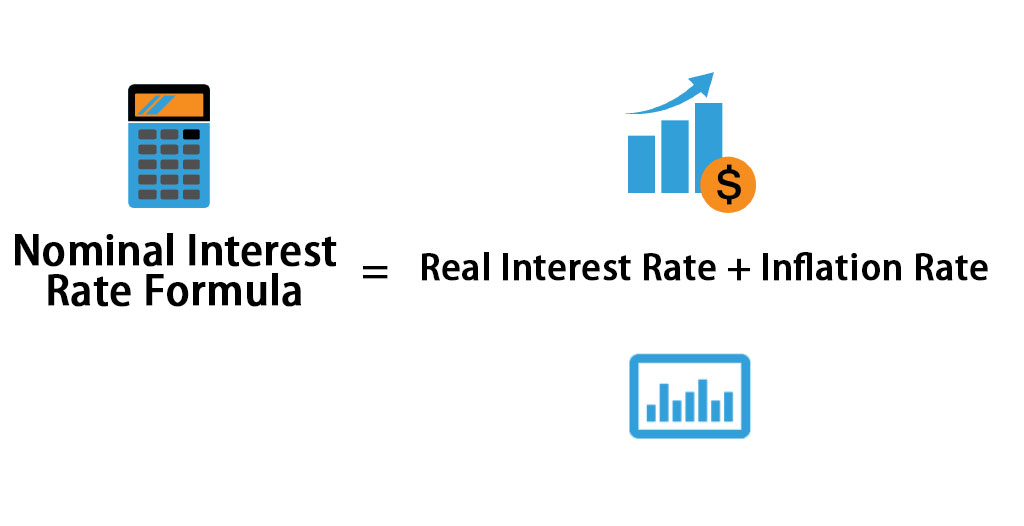

Nominal Interest Rate Formula Calculator Excel Template

Average Formula How To Calculate Average Calculator Excel Template

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

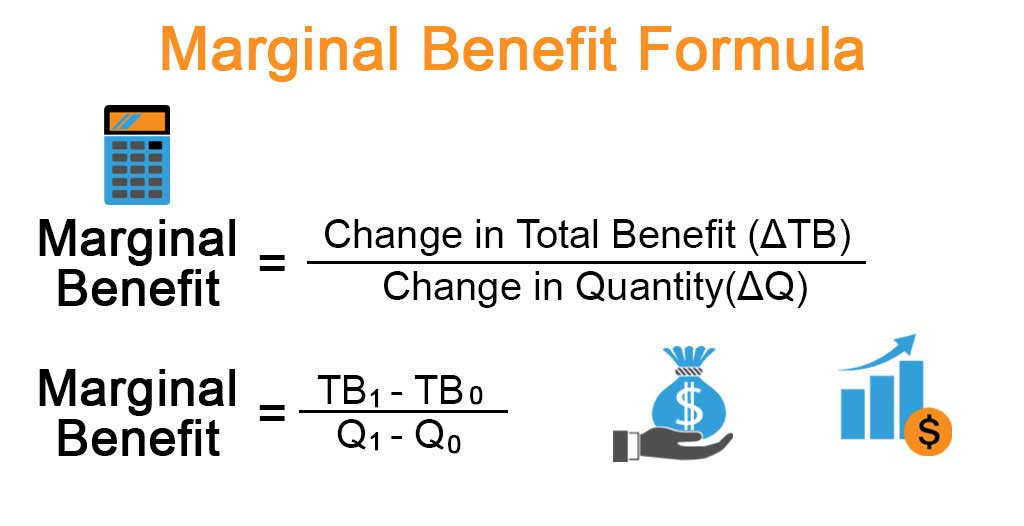

Marginal Benefit Formula Calculator Examples With Excel Template

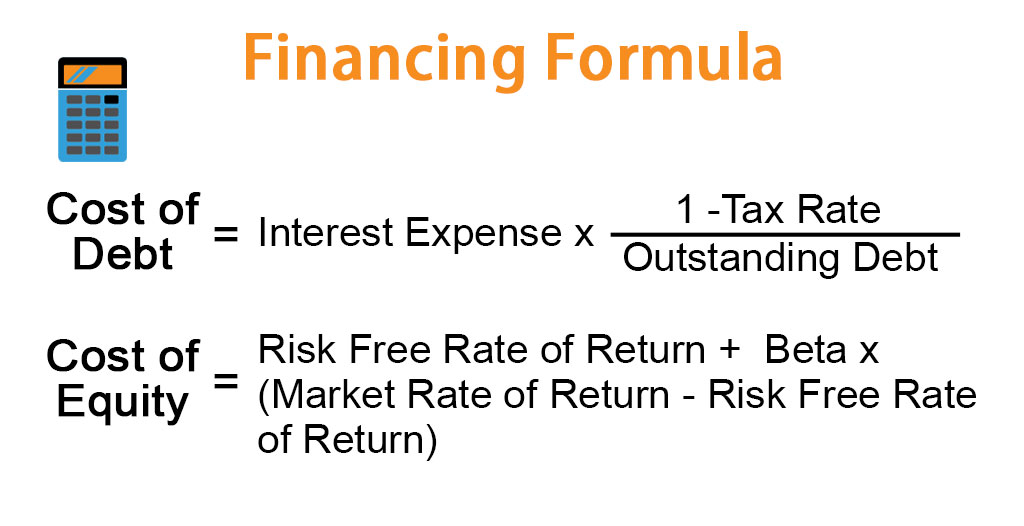

Financing Formula Calculator Example With Excel Template

Handy Home Blog Calculating How Much You Can Afford To Spend On A Mortgage Payment Buying First Home Home Buying Tips Home Buying

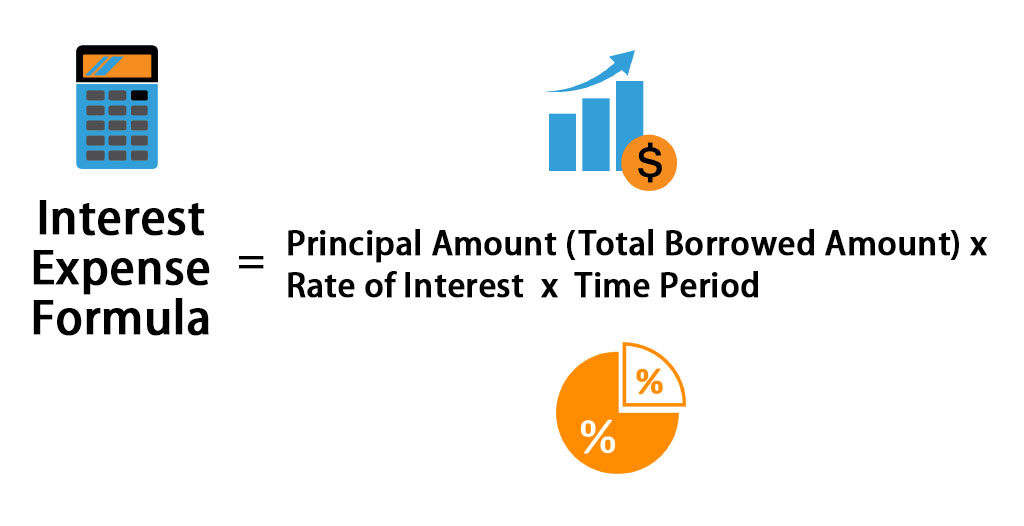

Interest Expense Formula Calculator Excel Template

Effective Annual Rate Formula Calculator Examples Excel Template

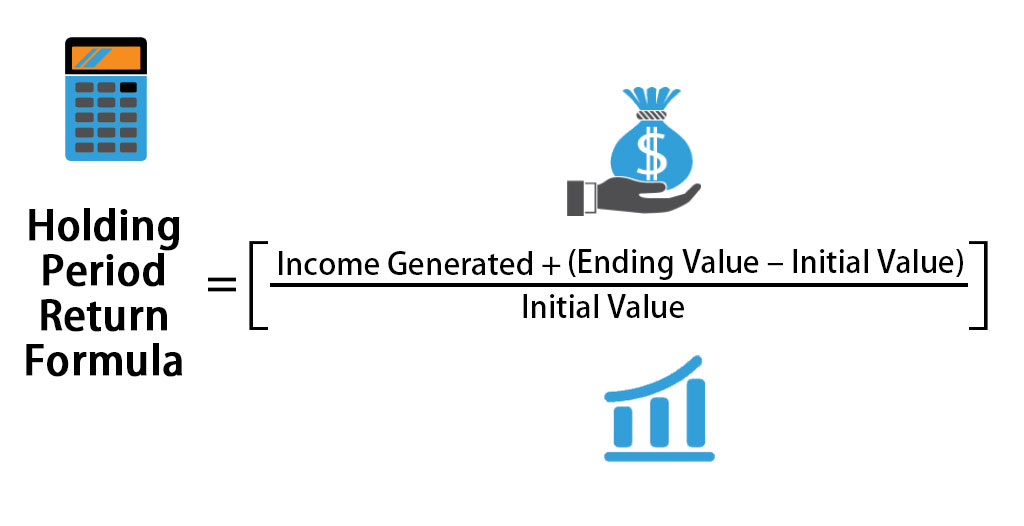

Holding Period Return Formula Calculator Excel Template

Moving Average Formula Calculator Examples With Excel Template